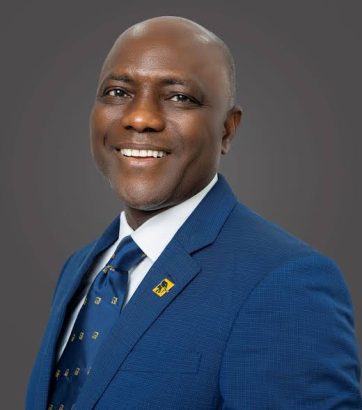

With Alebiosu, Firstbank transitions to growth consolidation era

FirstBank’s 130 years of gripping history is a corporate handbook in many ways. Its fortunes are as great a lesson as its challenges.

Its leadership and choice of leaders are fascinating chapters of the book it has become, validating the notion that each era in human history is shaped by the king of the moment.

This is true across the corporate environment but uniquely applicable to Nigeria’s premier bank.

For its diffused ownership structure, its leadership is particularly dynamic, adding a great deal of variety to the journey. The confirmation of Olusegun Alebiosu as the new Chief Executive officer of the bank is seen as a consolidation of the rich culture of the bank.

At a peculiar juncture in its 130 years of incorporation, the market has seen a new FirstBank that is ready to compete with the new entrants to recover the market it was holding in its grip as a monopolist.

The bank is consolidating on its adoption of the new ‘click’ banking through which it has invested heavily in digital infrastructure. The success Alebiosu helped to create at the corporate performance of Q1, the quarter heralding Alebiosu was particularly fascinating across top and bottom-line indicators.

First, the bank’s total assets leaped by 28 per cent year-on-year to N20.7 trillion, while gross earnings rose by 178 per cent to N682.5 billion on the back of strong growth in the credit portfolio (which was 33 per cent up from December 2023). Non-interest income, which reflected the robust transactional platforms, doubled year-on-year to N224.6 billion compared with N110 billion it earned in Q1 of 2023.

The Chief Executive Officer also rode on powerful bottom-line indicators with profit before tax seeing exponential growth of almost 300 per cent to N209.8 billion and profit after tax growing in the same margin to N188.5 billion.

These are not isolated figures but a reflection of a decade of robust performance of the banking group that feeds into the holding company that has become the toast of the investing public in recent years.

For one, FirstMobile, its digital banking application emerged as a household name in the financial technology ecosystem. In 2015, when the platform was still in its infancy stage, its user base was about 60,000, a figure that has soared to over six million as of last year.

That has contributed immensely to changing the market’s perception of the institution as a traditional bank to an innovative digital bank.

Today, over 85 per cent of its transactions are initiated via digital platforms, according to insights provided by the bank. That suggests that while it consolidates on its hedge as a saver’s bank, it has also emerged as a transaction-driven bank. FirstMobile appears to have hit the bull’s eye in the bank’s reinvention drive and efforts to appeal to younger demographics.

However, the platform is only one of the many telecommunications-driven initiatives the bank has innovated to get young depositors on board. FirstOnline has also grown in leaps in terms of users – from about 90,000 to over one million in less than a decade.

USSD banking, under the watch of the immediate past handler, is even more successful with users increasing by close to 3,000 per cent in the last eight years, to about 15 million.

What USSD banking, which targets feature phone users and rural communities where internet penetration is still very low, has done for the bank is giving a slice of it to the original owners – rural dwellers and non-Internet natives who had never known any other bank than FirstBank.

The success of Firstmonie Agent Banking also validates its agelong popularity in rural areas. Last year alone, its Firstmonie Agent Banking services processed over ₦1.1 trillion in transactions, more than double the amount handled by seven other big banks.

Its strategic investments in technology include the development of its interactive transaction banking platform known as FirstDirect2.0 and the introduction of the humanoid robot to the banking ecosystem in the country.

The smart banking initiatives have been complemented by its Digital Xperience Centres (DXC), which are currently located in Lagos, Ibadan, and Abuja with plans to open more across the country. Overall, its digital banking has evolved in both volume and public perception even with artificial intelligence-driven commercials complementing its digital imprints.

Ease, convenience and reliability created in recent years have moved the customer base from 0.6 million in 2015 to well over 42 million customer accounts as of 2023. This number, according to the immediate past Chief Executive Officer, Adesola Adeduntan, would double in no distant future as the organisation migrates more aggressively to transaction-led banking.

Last year, its holding company earned N171.8 billion in income from fees and commissions, a 46 per cent year-on-year growth, demonstrating its success as a transaction-led bank.

Its fee and commission income growth were not an exception but drew from impressive performances across the board. Its operating profit also jumped by 129 per cent, much higher than the industry average, to N361.8 per cent, leading to an earnings per share of N8.56k.

The total assets also saw a 60 per cent growth to N16.3 trillion. The total assets, like other metrics, had seen over 300 per cent expansion from 2015 when it was N4.2 trillion. FirstBank also experienced aggressive growth in its customer base in the past nine years.

The figure has grown from 10.9 million to over 42 million customers, leading to the aggressive growth of fee and commission income of the bank.